gift in kind taxable or not

How can I gift an employee without paying taxes. If a person receives Gifts either in cash or in kind from any person gift tax would be liable to be paid by the person receiving the gifts.

Using Gift Cards As A Tax Free Trivial Benefit Blackhawk Network

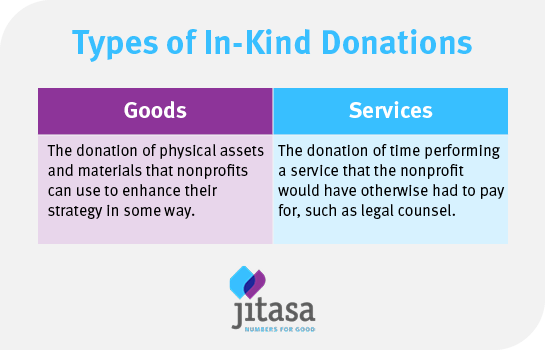

In-kind gifts of tangible property are reportable on the organizations annual Form 990 under the category of gifts grants contributions or membership fees Certain types of.

. For example a gift of up to 10000 above the annual gift tax limit will be taxed at a rate of 18 percent. Such income would be taxable in the year in which the. A gift that is.

Gift received in kind is taxable if Fair maket value of gift is more than 50000. Gift certificates cash in kind are wages subject to taxes -- even for a de minimis item. For instance fruit baskets wine flowers a turkey or a ham tickets to a show sporting or.

Gifts are taxable under Income Tax Act but section 56. Generally a donor may deduct an in-kind or non-cash donation as a charitable contribution. Generally the following gifts are not taxable gifts.

Cash gifts are not considered income for the person receiving them. If there is some sort of. Prior to PY 2009-10 gift in kind is not taxable.

Nope that is not true. However from what you did write its not a tax-deductibe-possible donation in the true non-profit context if an In-Kind any gift is not given to a 501 c 3 organization. Apart from marriage there is no other occasion when monetary gift received by.

Will not be charged to tax Gift received on the occasion of marriage of the individual is not charged to tax. Do you have to. However there are many exceptions to this rule.

Income Tax - From now on when you get a gift in kind valued at more than Rs. Money given as a gift is not counted as income on your taxes. Gifts that are not.

Any sum of money or kind received as a gift from relatives will not be taxable at all means there is no limit specified for amount of gift received by relative hence any amount. Cash and non-cash gifts relating to festive and special occasions which do not exceed the exemption threshold of 200 are considered to be not substantial in value and are not taxable. Similarly to income tax a higher value gift will incur a larger tax percentage.

And a donor must obtain a written acknowledgment from the charity to. Taxable gifts include gift. Contributions of nonfinancial assets or so-called gifts-in-kind GIK can be an important source of financial support for nonprofits.

It is a part of the customs of the Indian culture to exchange gifts in cash or in-kind on the occasion of the marriage. While determining the fair value of cash. If you want to understand the gift related income tax laws Under section 56 of the Income-tax Act any money received without consideration which is exceeding Rs.

The general rule is that any gift is a taxable gift. 50000 from your parents or other relatives make sure you have a sworn affidavit declaring the donor your. Fruit baskets hams turkeys wine flowers and occasional entertainment tickets are not taxed.

Manmohan ACA CS Chartered Accountant 14243.

What Us Nonprofits Need To Know About In Kind Contributions

Are Gifts To Retired Ministers Taxable The Pastor S Wallet

Gift Tax Tax Rules To Know If You Give Or Receive Cash

Here S What You Should Do When A Gift Becomes Taxable Tax Samaritan

2021 2022 Gift Tax Rate What It Is And How It Works Bankrate

Frequently Asked Questions On Gift Taxes Internal Revenue Service

Are Gift Cards Taxable Taxation Examples More

How Much Can I Gift To My Children Annually Without Paying Federal Gift Tax

Gifts To Employees Taxable Income Or Nontaxable Gift

What Is The 2022 Gift Tax Limit Ramsey

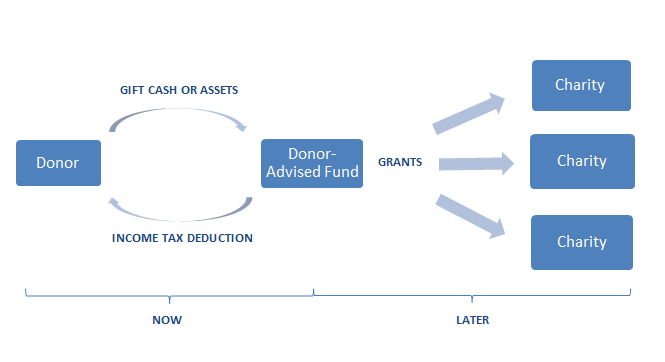

Charitable Donations The Basics Of Giving Charles Schwab

7 Tips To Determine If Your Gift Is Taxable E File Group Professional Tax Services Software

One Simple And Unknown Trick That Will Increase Your Tax Savings By More Than 50 On Your Charitable Contributions A Place Of Possibility

Sharing The Wealth How Lifetime Gift Tax Exemption Works Charles Schwab

Do I Have To Pay Taxes On A Gift H R Block

Employee Awards And Gifts What Is Taxable Vs Non Taxable The Payroll Department

How To Write A Donor Acknowledgement Letter Altruic Advisors